Which are the alternatives in order to a funds-away refinance?

It’s a good idea knowing how much you want beforehand. If you are gonna make use of the currency having domestic developments, earliest find some quotes of designers so you’ll have an effective thought of exactly what people improvements will cost. To pay off large-interest financial obligation, particularly playing cards, tally that total before asking for cash-away refinance.

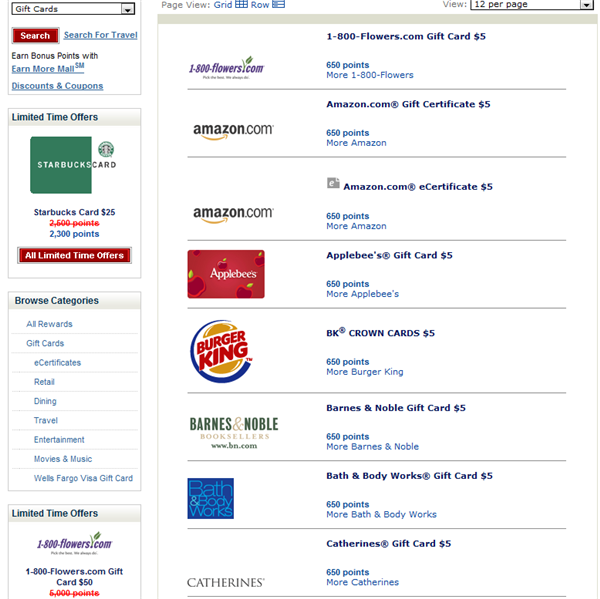

There are various scenarios where an earnings-out refinance is not the best mortgage option: We would like to keep settlement costs down You really have less than 31-40% equity in the home You are trying a somewhat bit of cash, state $5,100 $20,000.

Domestic Collateral Line of credit: Exactly how try a great HELOC distinct from a cash-away re-finance?

Property equity personal line of credit (HELOC) differs a lot more regarding a profit-out refinance. Will still be secured by your house, nonetheless it does not improve your current loan. It is a supplementary, entirely separate loan, this is the reason HELOCs are sometimes also known as second mortgages.

You could contemplate an effective HELOC like an unbarred-finished loan, quite particularly a credit card. Your borrow secured on new HELOC due to the fact you desire pops up, while your pay, you have still got accessibility obtain once again around the latest offered restrict.

Most HELOCs incorporate a variable interest rate, which means the pace can transform every month. The lending company lets attention-simply payments to own a certain amount of some time the borrower can just only availability these financing to own 10 years, which is called the fresh new mark months. In the event the mark several months is over, you pay a normal monthly payment which will completely repay the fresh mortgage harmony, usually over an extra 10 years.

Home Security Loan: Exactly how is property equity Financing not the same as a cash-away refinance?

A property collateral financing, and secure by your domestic, is actually for a predetermined sum of money which you pay more a fixed length of time. Such a property equity line, its an additional loan one lies at the top of your number one home loan.

However, rather than a property collateral range, you don’t need accessibility borrow money repeatedly. Thus speaking of better for one-go out projects.

The amount you could potentially obtain often is inspect site 85 percent otherwise less of your security you really have of your home. Your revenue, your credit report, and market price of your home including factor in to help you determine how far you could potentially acquire.

Cash-out re-finance: Transforms your financial with the an alternate big you to, having to thirty years to pay it off. In the end, you merely get one mortgage.

Do a money-out financing, household security loan, otherwise an unsecured loan work best for your problem?

How much time you’ve owned your home, along with your current interest is always to basis in the choice on what sort of financing work a knowledgeable for you. Check out the following the conditions and determine which one matches your needs:

Resident No. 1, two, features a top-interest rate (8% or maybe more) to their most recent mortgage and you may they’ve got received a sizable number of guarantee (70-85%). That it resident desires to straight down their attention speed and at this new same date take out some money. Your house was of sufficient age you to some renovations wouldn’t wait lengthier, and they had wish improve the property value their residence when you look at the case they would like to offer and you will downsize later. Homeowner Zero. 1 is a great candidate to possess a funds-out re-finance.

Resident Zero. 2, a family, has just purchased the house these include residing, so that they do not have far collateral yet ,. It family unit members appears toward delivering its kid to college inside the 24 months but does not a bit understand how they are going to manage it versus burying these when you look at the student loan debt. Most other residents within category might require currency having family fixes, or perhaps to spend the credit card debt. All of these people is most appropriate to either a personal financing otherwise a credit line.

دیدگاهتان را بنویسید

برای نوشتن دیدگاه باید وارد بشوید.