What is the added bonus having a bank to re-finance home financing at the a lowered rates?

I am unable to find out why finance companies would positively try to get their customers so you’re able to re-finance its home loan within a lowered interest rate. And feel surely obvious, What i’m saying is a bank refinancing a loan within its individual lender (Wells Fargo refinancing a loan away from Wells Fargo). What exactly are the incentives?

- They make some money regarding the closing costs

- It resets this new amortization schedule and that means you was spending increased portion of your fee once the attract

Although variation isn’t really much after you might have only had the prior financing for some years. And you will what’s really complicated would be the fact finance companies in america right now have to give refinancing and no closing costs.

I would always benefit from one among these no-prices closing refinances but I am afraid which i have to be shed some thing larger in the event the banking institutions want to cut myself currency. The fresh new crazy situation would be the fact I can refinance my 30 seasons (where I’ve 27 decades going) into the a 20 year within a lesser rate of interest and you will spend nearly an equivalent matter a month. Just what am We destroyed?

What is the added bonus for a financial in order to refinance a mortgage at the a lesser rate?

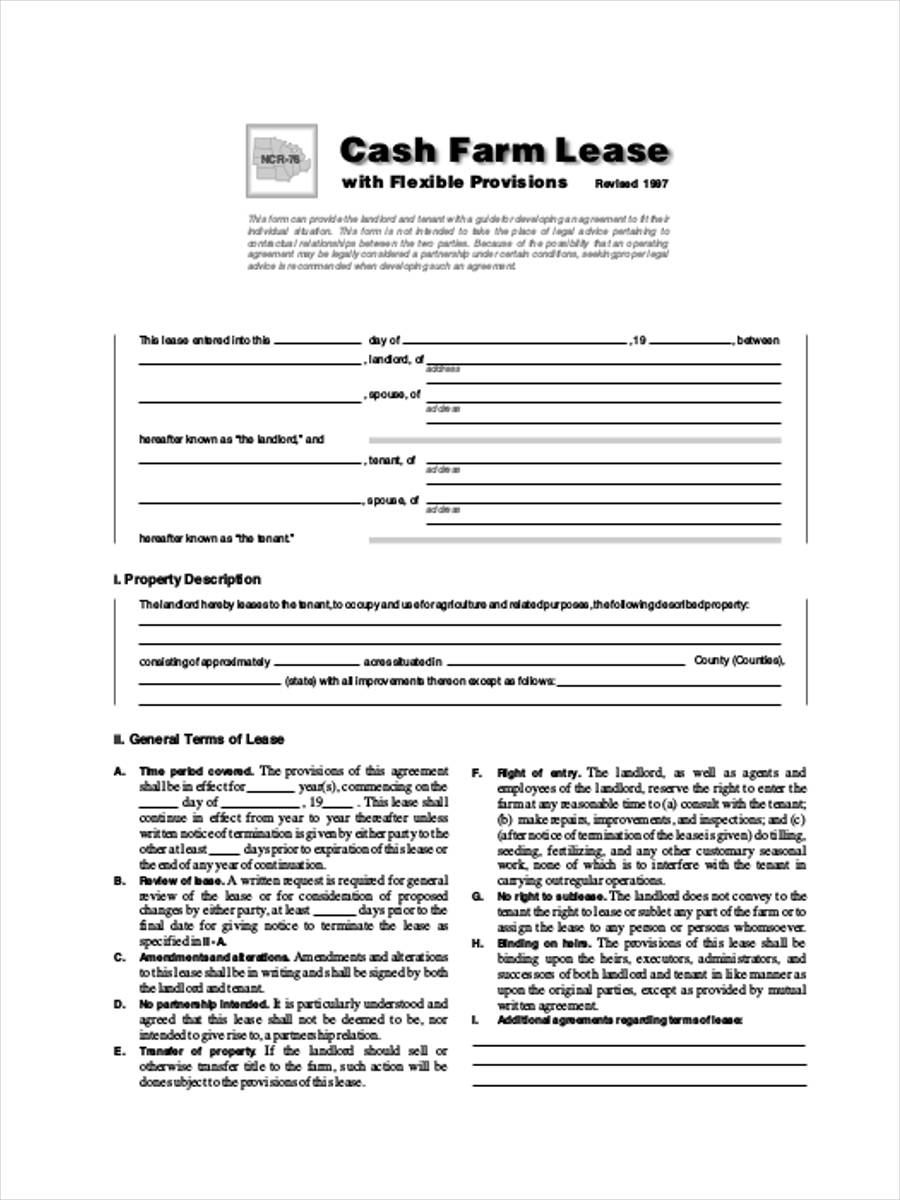

This really is a 30 season $402k fixed within cuatro.875% which have 27 many years left refinanced to 20 12 months repaired within cuatro.125%. Payment per month goes off $dos, so you’re able to $dos,. How so is this a whole lot for Wells Fargo?

- united-claims

- mortgage

- refinance

۸ Responses 8

In a lot of circumstances, the lending company has made their cash. Immediately after you get your own financial is available so you can buyers even in the event the financial institution remains repair it to own a charge. Thus, for many who re-finance, they arrive at sell again.

There may also be certain comedy-currency reasons regarding to be able to amount this given that another sales.

It can be the best thing into bank to re-finance the loan for you – because you could be staying the mortgage at this style of place. This gives them additional time to enjoy the newest free money your pay them inside appeal towards the kept longevity of the loan.

Financial institutions that provide “No settlement costs” is betting that home loan payers usually flow its financial discover the low interest rates – and you may anyone who retains the mortgage, gets the appeal money.

Finance companies make money on weight origination costs. The fresh new “points” you only pay otherwise settlement costs certainly are the primary benefit to brand new banking companies. An enormous majority of the amount of time threats associated with the financial are sold to some other cluster.

FYI, an identical holds true that have financing finance companies. Overall, the order will set you back (which can be overlooked because of the modern financing idea) will be chief issue running this new bonuses towards globe.

۱- Wells Fargo doesn’t own the current home loan. He’s included it and sold it as a financial investment. 2- They generate their money out of ‘servicing’ the loan. Even if they merely rating $50 a month to provider they (3% in our monthly payment), that results in $50,000,000 a month if they have so many house significantly less than government. Which is $600 mil a-year for every million belongings becoming maintained step 3- Managing the escrow becomes them a lot more cash, as they can dedicate they and secure dos-3%. If the 1,000,000 house possess the typical equilibrium regarding $dos,000 within escrow membership, they are able to earn to $60 annually, otherwise $60,000,000 per year. 4- They make $step one,000 each time they refinance your house. This is actually the approximate cash after paying genuine settlement costs. Refinance the individuals mil land, and you also build a very good million inside earnings! 5- Nevertheless they desire to be certain that they keep us as the a customers. By the lowering all of our percentage, it reduce the likelyhood that we have a tendency to re-finance that have other people, therefore is actually less likely to want to standard. (Not that it remove when we standard, because they don’t own the borrowed funds!) 6- they make even more gain repaying the old mortgage (they will not contain it… remember), next packaging and you may promoting the brand new mortgage. Since they are selling it as a protection, they sell for coming worthy of, meaning they offer all of our $2 hundred,000 mortgage to have a valuation of $360,000. Consequently they sell for $two hundred,000 Many tiny fraction of your most $160,000. Can you best payday loans in New Hampshire imagine they only wanted a good ten% advanced of your own $360,000 valuation. It means they promote our very own $2 hundred,000 financing to have $236,000. It wallet $thirty-six,000. Once they build so many of these deals from year to year, that’s $36 million bucks into the earnings

$۶۶۰,۰۰۰,۰۰۰ a year so you can services the loan (Little or no risk, because it’s are paid down by the manager of your financing just like the a support commission)

If they take care of the fund because of their expereince of living (remain united states regarding refinancing that have someone else…), they could create $19,800,000,000 (that is 19.8 billion bucks into the servicing charge)

New money they make in a good refinance is a lot higher than the money next can make of the carrying the mortgage getting 30 age.

دیدگاهتان را بنویسید

برای نوشتن دیدگاه باید وارد بشوید.