What is actually security and how do I understand just how much We have?

Evaluate remortgaging mortgages

What is actually guarantee as well as how do you require the money your has actually of your property so you’re able to borrow funds to other motives otherwise to pay off debts?

Guarantee is the show you possess of one’s property value your own family. Such as for example, in case your house is really worth ?200,one hundred thousand plus financial are ?150,000, your own collateral try ?fifty,100.

Security ‘s the value of your property that you do not shell out one mortgage to your. This may involve the amount of put your in the first place installed when you purchased they.

You pay down (reduce) your own mortgage personal debt which have an installment mortgage (yet not an interest-just home loan). This means, you pay off the fundamental financial personal debt to eliminate the amount of money you might be borrowing from the bank otherwise building area

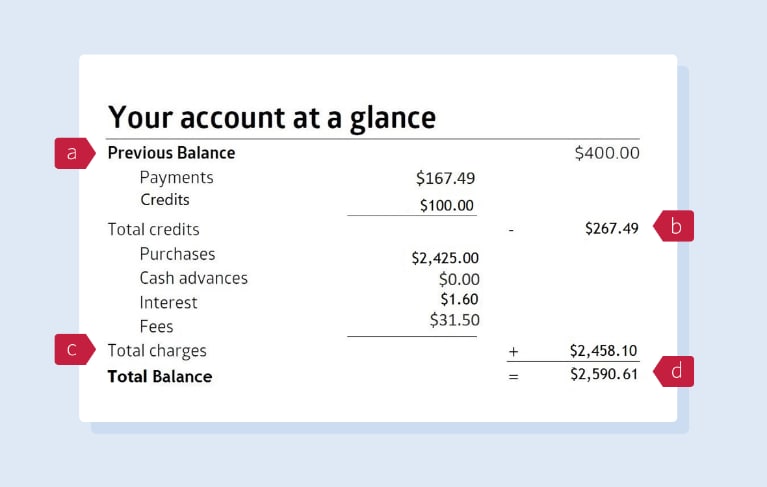

You could figure out how far guarantee you have got from the subtracting the left home loan debt from the genuine property value your home.

The value of your house try ?350,one hundred thousand when you got it. You put in in initial deposit from ?35,100000 and you may took aside home financing out-of ?315,100. You made home loan repayments worth ?20,one hundred thousand which means your equity is now ?55,000. Which departs a remainder off ?295,100 remaining to invest on your own mortgage.

Don’t forget that domestic thinking carry out vary and you may, if you’ve got your home valued by the mortgage lender having borrowing from the bank aim, the value is almost certainly not equally as high as prices of property websites.

As to the reasons you’ll I must use equity in my house getting credit?

It is not uncommon having residents to help you borrow secured on their security of the remortgaging to own increased total get a finances lump sum payment, have a tendency to to fund renovations which can create value .

This might be known as remortgaging to apply for 24 hour loan online in Mccalla Alabama produce security, otherwise remortgage collateral release. When you need to remortgage to release equity you want to contact your mortgage lender otherwise remortgage with a new lender to release the bucks.

With financial pricing seemingly reduced, remortgaging may seem like the lowest priced cure for use huge amounts of money. But borrowing a whole lot more function spending a great deal more interest more than a fairly long period of time it would not continually be a better suggestion than simply an initial-title mortgage.

How exactly to availableness their guarantee

The most obvious solution to availability their security is through selling your residence. Generally speaking, your own equity will be place for the in initial deposit to find a good brand new home however could keep right back some of the currency for almost every other motives.

Don’t forget that when you do promote your property you will features exchanging will cost you also solicitor’s fees and you will removal will cost you to expend while the extra cost of taking up more substantial home loan whenever you are waiting on hold for some of the security. Definitely weigh the huge benefits and you can drawbacks prior to taking so it action.

Should i use the security in my house because the a deposit?

Sure, if for example the security has increased, you can use it just like the larger put and you may safer down financial prices, and maybe even purchase a property downright.

For individuals who ‘downsize’ and move into a reduced worthy of domestic, you might turn your equity for the bucks if you have certain left-over after you have bought your house.

Ideas on how to remortgage to release equity from your own home

Or even need certainly to disperse house or downsize, you might remortgage in order to borrow secured on the value locked up during the their guarantee by using a unique bank otherwise bringing an excellent the new deal with your current you to. So it works by taking right out a new mortgage which is big than simply your mortgage.

دیدگاهتان را بنویسید

برای نوشتن دیدگاه باید وارد بشوید.