Veterans, active people, and you can thriving spouses that have a reduced annual income may be eligible to have a great Virtual assistant loan

USDA Point 502 Guaranteed Financing System

Known as new Rural Innovation financing, this option assists potential reasonable-earnings property owners buy a house versus and come up with any advance payment on all. The big importance of this mortgage, however, is the fact its only available without a doubt functions which might be located from inside the rural places.

According to USDA, qualified individuals may use the loan buying, create, rehabilitate, raise, or relocate a home inside the a qualified rural town that have 100% capital. In addition, the program claims 90% of the loan, very loan providers are particularly comfortable knowing there clearly was faster chance in order to approve instance that loan instead of a deposit.

Applicants hoping to get with the this option try not to meet or exceed 115% of median household earnings on the chosen region. They have to and commit to actually inhabit the home since the their top home and additionally they should be a good U.S. resident, You.S. non-citizen federal, otherwise qualified alien.

Va Money

Available with the newest U.S. Department off Experts Factors (prior to now the fresh new Veterans Management), this type of fund are created to hook up most recent or former army employees which have use of loans away from private loan providers at the competitive pricing.

When you’re acquiring home loan help from brand new Va, know that there is no significance of a down-payment together with vendor can help cover your own closing costs. Also, it does not want one month-to-month financial insurance coverage.

Qualification is dependent on the kind of solution as well as for how a lot of time you or your loved one supported. If you are currently to the energetic duty otherwise their services try through the wartime, need about 3 months of experience. In the event your solution try through the peacetime, you desire 181 or even more weeks. If perhaps you were broke up about provider, you really need to have been in this service membership to have two years otherwise the full ordered time of the provider. Incase you had been throughout the National Guard or Put aside, you’ll want supported no less than half dozen ages.

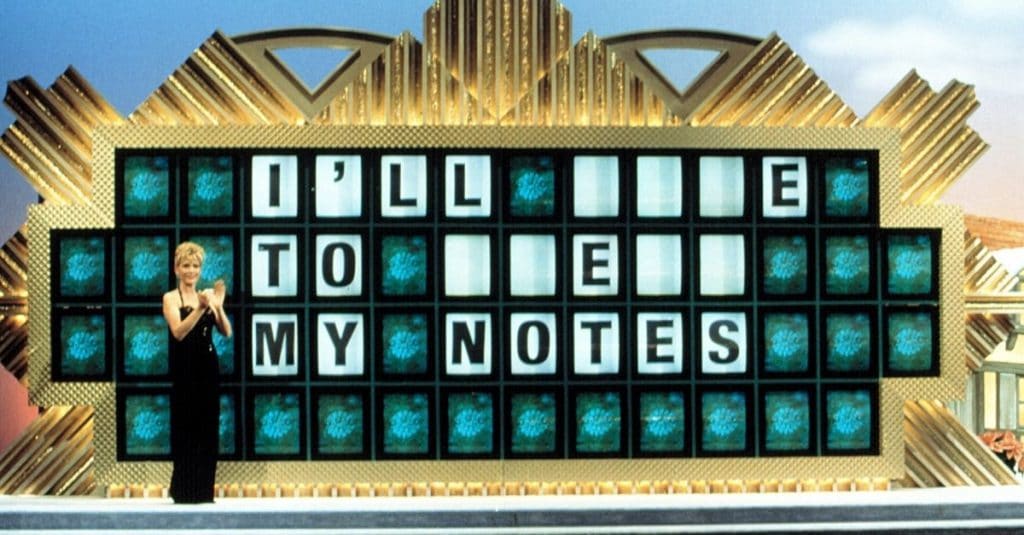

As you s in the list above, keep in mind that truth commonly vary per. Therefore, you ought to have a look at

Says Can offer Advice

Together with help from government entities, the 50 states and U.S. regions are capable to include leasing, homeownership, and you will domestic to shop for recommendations. Sponsored by your condition otherwise local governing bodies, this type of software vary for the a state-to-condition foundation.

To find out more regarding your nation’s housing assistance applications, including one home mortgage apps, be sure to check out your own state’s HUD web page. According to county and its particular resources, assistance can come when it comes to downpayment advice, features, otherwise forgivable loans. Qualification and requires may vary according to the condition where you stand looking to getting a citizen.

Certain applications do view it not financing financing having financing or blended-used characteristics thus ensure you may be well-aware of laws before you apply.

What Comprises Lower income?

If you’re looking from the current housing industry and you can thinking if the it is possible to pay for your first family, or if you are searching to maneuver to your a different you to definitely, next understanding where your earnings stands can help you find the right home loan to you personally. You won’t just upcoming know how much you can afford a month into the payments, but you may also be able to make the most of special fund otherwise software if you like certain even more help.

To the a nationwide level, getting considered “a decreased-income family” means the complete money that everyone over the ages of 15 home brings in per year is actually below two-thirds of your own median money. According to an effective 2021 statement by the You.S. Census Bureau, the average family income in 2020 try $67,521. From inside the good 2020 report regarding the Pew Browse Center, lower-income properties entice “less than around $40,100.”

دیدگاهتان را بنویسید

برای نوشتن دیدگاه باید وارد بشوید.