They’ve paid down extremely otherwise all of their home loan

Matt Webber is actually a talented private finance journalist, researcher, and you can publisher. He has got had written commonly for the individual money, profit, and the feeling off technology with the modern arts and you can culture.

Lea Uradu, J.D. are a beneficial Maryland State Joined Tax Preparer, Condition Specialized Notary Personal, Formal VITA Taxation Preparer, Internal revenue service Yearly Processing 12 months Program Participant, and you may Income tax Creator.

Older people, specifically elderly retirees which haven’t struggled to obtain years and you may whose money away from discounts or investment could be limited, shall be domestic rich however, bucks worst. But really they are able to fall into a monetary bind when they you need more money than just he’s got offered.

An other mortgage is a type of home loan that will let those who work in for example points. It’s intended for home owners years 62 otherwise old that have extreme family guarantee.

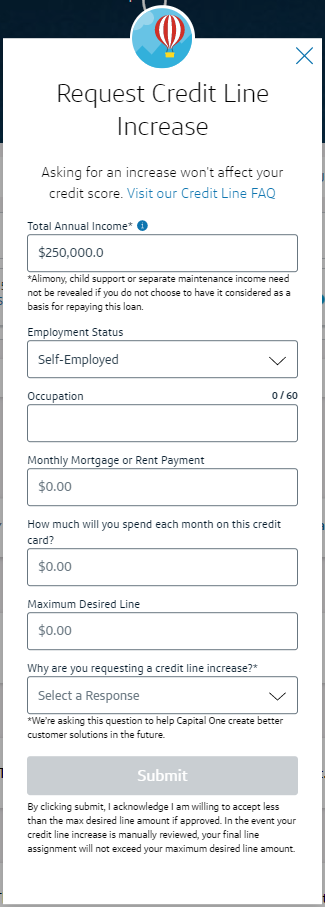

That have an other financial, property owners can also be borrow cash up against the property value their houses and you will take the profit numerous ways. Such loans Segundo CO as for instance, they’re able to get the mortgage as the both a lump sum payment or an everyday and fixed payment per month. Otherwise it can be taken to all of them given that a line of credit.

Notably, the money loaned to them becomes owed merely when they perish, get-out of the home permanently, otherwise sell it.

Its an appealing economic proposition whenever diminished money is, or can be, a long-term problem. Although not, there were some worrisome facts pertaining to exactly how contrary mortgages try reported.

Key Takeaways

- Multiple federal guidelines-such as the Mortgage Acts and Means Advertisements Code (Maps Rule), happening into the Financing Act (TILA), together with User Financial Defense Operate regarding 2010-manage the way that reverse mortgages shall be said.

- These laws stop deceptive says into the mortgage advertising and most other industrial telecommunications provided for people of the mortgage brokers, lenders, services, and you will advertising providers.

- A lot of states have likewise passed laws and regulations to deal with opposite home loan advertisements.

- Despite these types of laws and regulations, the user Economic Defense Bureau (CFPB) enjoys elevated issues about how reverse mortgages is said.

- Consumers can be wary about ads to own contrary mortgage loans you to present the item once the a source of income or a national work with; reverse mortgage loans was loans and may end up being addressed as a result.

Complications with Reverse Financial Advertising

Indeed there constantly appear to be an eternal affect away from cons one to target the elderly as well as their money. Reverse mortgage loans was found in these types of.

One out, reverse mortgage loans possess inherent risks and this the possible debtor need thought. Such as for example, it’s possible whenever an excellent homeowner’s demise, the remaining lover or students you are going to eradicate the household house. Prospective charge (closure and continuing) may affect their liquidity, too.

Unsafe Ads

Yet not, in addition to the item’s genuine potential pitfalls, here have started period in which contrary mortgages was indeed demonstrated or reported having incorrect states.

Such as for example, a ca-dependent opposite mortgage broker incorrectly told prospective customers one an opposite home loan will mean zero repayments. The fresh representative further advertised one borrowers wouldn’t be at the mercy of expenses associated with refinancing a face-to-face financial.

In truth, individuals who remove a face-to-face financial do incur a variety off will cost you, in addition to charges to own closing, appraisals, label insurance rates, and you may possessions, insurance policies, and you will restoration fees.

Due to consumer misunderstandings, certain says has enacted laws that prohibit exactly what lenders can and you can can not state after they give reverse mortgages. This type of regulations come into introduction to help you federal laws and regulations you to definitely handle how mortgage loans might be said.

Moreover, brand new CFPB possess several times raised issues about how opposite mortgage loans is actually claimed. When you look at the a 2015 report, the fresh new institution reported that shortly after seeing adverts to possess opposite mortgages, people was unclear about opposite mortgage loans are fund, in addition they were left with not the case thoughts they are a great government work for otherwise which they perform verify consumers you’ll stay-in their homes for the rest of its lifestyle.

دیدگاهتان را بنویسید

برای نوشتن دیدگاه باید وارد بشوید.