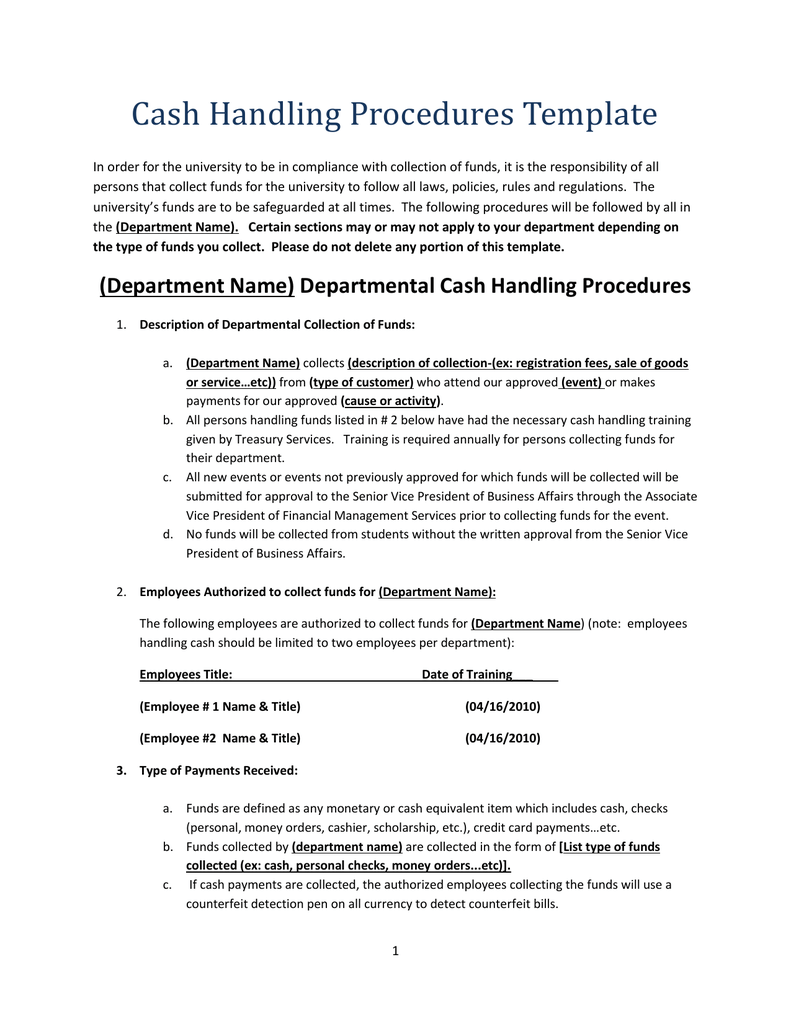

Precisely what does LTV Suggest to suit your Mortgage?

In this post discover the LTV (loan-to-value) calculator that can be used to sort out new LTV towards their home loan. you will select information on just what LTV mode and just how they affects your own mortgage payments.

What is My Mortgage-to-Well worth?

This is not a price under the Consumer credit Act. Financial app approvals also are susceptible to recognition of income, credit monitors and you can a home valuation.

What is Financing-to-Worth?

Because the an initial-go out buyer you happen to be commonly bombarded with a lot of slang when you begin applying for a home loan, such fixed rate, SVR, focus simply, cashback and. One to globe title that usually harvest upwards and one you need to discover try financing-to-worth ratio otherwise LTV.

Your own LTV is the ratio between the loan amount plus the value of the property. It can be a small complicated as it is usually expressed because a share. We direct you ideas on how to workout your LTV yourself, lower than.

The new Topics Safeguarded on this page Are listed below:

- What is My personal Loan-to-Really worth?

- What is actually Mortgage-to-Value?

- Ideas on how to Workout LTV

- What your Loan-to-Value Method for Payments

- What does LTV Indicate to suit your Mortgage?

- What is actually a good LTV having a home loan?

- How-to Estimate Financing-to-Really worth

- Evaluate Home loan Cost by the LTV

- Calculating LTV getting Pick-to-Let Mortgage loans

Ideas on how to Work-out LTV

You can exercise their LTV by separating your loan number from the property value the home right after which multiplying so it number because of the 100.

Exactly what your Mortgage-to-Value Way for Costs

It is critical to keep in mind that you’ll merely pay off and start to become energized desire for the count you acquire, perhaps not an entire value of the home. Hence, need your loan-to-well worth as as little as you can easily as shorter you obtain, the new faster you pay back to the long term.

Maximum LTV you might sign up for towards the a home loan was generally speaking 95% for example the minimum put you’d need to lay out are 5%.

Loan providers explore LTV to assess the possibility of credit money so you’re able to mortgage people. Away from a good lender’s direction, the greater new LTV, the new riskier it is to enable them to provide to you personally. They could cost you a top interest rate or ask you to answer to add more evidence of your income to ensure you could pay the payments.

How much does LTV Indicate for your Remortgage?

Essentially, the reduced the latest LTV, the higher new deals available. In terms of remortgaging, also switching away from a good 95% price in order to an excellent 90% one can possibly reduce your notice costs. Bear in mind that ERCs (early repayment charges) could possibly get pertain, according to terms of your own home loan while your get-off a specific financial plan.

What is good LTV getting a mortgage?

An excellent LTV for a mortgage can depend on the financial problem, new property’s worthy of therefore the lender’s standards. Less ratio tends to be noticed finest. In most cases out-of thumb, a minimal LTV was anything from 75% having a 25% put and you will lower than. A beneficial 75% LTV offers all the way down rates, when you are a beneficial 65% LTV eg you certainly will leave you access to a whole lot more aggressive business.

Nevertheless, saving 25% to own in initial deposit can be very challenging for many of us, specifically very first-time customers for this reason there are many mortgage possibilities for individuals which have LTVs from the 80%, 90%, plus 95%. There are also several 100% LTV mortgages situations on the market. Yet not, be aware that the better this new LTV, the greater amount of desire you are able to pay.

Tips Determine Loan-to-Value

Calculating your loan-to-worthy of ratio is fairly simple. Everything you need to manage are split extent you would like so you’re able to use because of the property’s overall really worth. You should next proliferate the outcome by the 100 to get a beneficial percentage. As an example, if you want to purchase a home value ?250,000 and now have a deposit from ?31,000, you will need to use the remaining ?220,000. You’ll ergo need certainly to separate 220,000 by the 250,000, hence translates to 0.88 providing you a keen LTV regarding 88%.

Compare Mortgages Rates from the LTV

Evaluating mortgage loans by LTV try a switch part of going for an excellent home loan. A lower LTV was typically thought less risky to possess loan providers and allows individuals to access significantly more competitive sale.

Examine mortgage loans because of the LTV, you can make use of our earliest-go out buyers better acquisitions unit. You only go into the property rates together with count you would like to acquire. Our very own best shopping uses this informative article to provide you having mortgage sale at this LTV. installment loan Maryland If you’d like to know exactly exactly what LTV the newest deals displayed to you was, you might go into the assets price/worthy of additionally the loan amount necessary towards the LTV calculator more than.

Keep in mind that their LTV vary when you remove your own financial as your property’s really worth transform so when you only pay out-of more of the home loan. As a result as time passes, after you have accumulated a whole lot more equity on your assets, it is possible to bring a much bigger put once you disperse family otherwise remortgage onto a far greater contract.

Lenders thought buy-to-let mortgages are riskier hence give at lower LTVs than just basic domestic mortgage loans. The maximum you can expect to borrow secured on a buy-to-help financial is actually 75% – 80% of the property really worth.

So you can assess this new LTV getting a buy-to-help mortgage, you will have to understand the value of the house or property you prefer purchasing, such as, ?300,000. You ought to together with understand the matter you have when you look at the deposit, elizabeth.g. ?75,000 and that everything you plan to acquire on lender, elizabeth.grams. ?225,000. You need to split the loan count from the property value and multiply the entire by 100.

It formula shows that the LTV is actually 75%. The borrowed funds loan will cover 75% of the property worthy of while the deposit covers twenty-five%. According to it LTV, the financial institution may require a rental money anywhere between ?step one, and you may ?step 1, to help with the borrowed funds. That it assumes mortgage off 4.49% so you’re able to 5.09%, and the bank requires 125% of your own monthly attention fee since leasing earnings.

دیدگاهتان را بنویسید

برای نوشتن دیدگاه باید وارد بشوید.