Mediocre HELOC Balance right up 2.7% inside the 2023

The average HELOC harmony rose so you can $42,139 about third quarter off 2023, upwards 2.7% on the $41,045 average a year earlier.

In this post:

- Total HELOC Stability Improved six.6% within the 2023

- Just what Needed for a beneficial HELOC (As well as Equity)

- HELOC Borrowing from the bank Constraints Are up inside the 2023

- Young Residents Very likely to Be Scraping House Equity

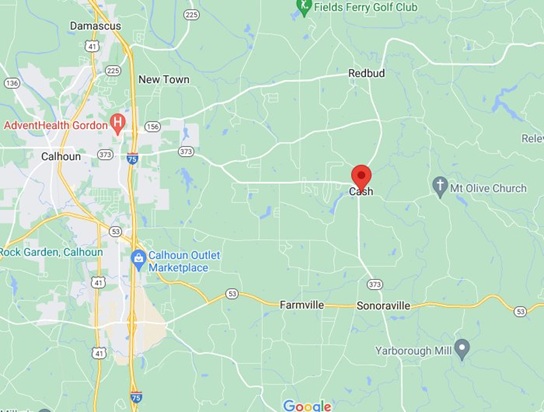

- HELOC Balance Rise for the majority Claims

One thing that continues to manage part of a lot property owners is the guarantee in their house. Residential a residential property features appreciated from the $15 trillion, so you can over $58 trillion, because the 2020, depending on the Government Reserve. Meanwhile, people gradually paying off the mortgages were racking up security even less than in previous decades.

Of numerous homeowners might use the newest win, because the price of most other goods and services continues to vary and you can large-violation products, such as for example the brand new vehicles, insurance premiums and you will recovery can cost you, try hiking almost as quickly as home prices.

Since the home values raise, far more residents is actually leverage a number of you to newly obtained wealth in the type of family collateral personal lines of credit, otherwise HELOCs. By credit some of the property value a house, residents can create renovations otherwise combine, reduce or pay large-notice costs. Inside the 2023, the common HELOC equilibrium expanded 2.7% in order to $42,139, and most $20 billion are added to the entire HELOC loans all over all U.S. people.

As part of the continued visibility of credit and financial obligation, we tested anonymized Experian borrowing research to see or watch recent trend at your home resource industry, as well as HELOCs.

Overall HELOC Stability Enhanced six.6% in 2023

It wasn’t usually in this way, however. The way in which people have gone on the tapping their home collateral has developed on the 2010s, when refinancing a mortgage pricing bumped along side step 3% to 4% Apr assortment. In those days, micro loans for Timnath this new go-to maneuver would be to re-finance an existing financial which have a more impressive mortgage (usually that have a diminished Annual percentage rate) and money away any extra finance, that can receive money straight back throughout that glossy new financial.

In the 2010s, interest in HELOCs waned as financial institutions well-known to give more lucrative home loan refinances to homeowners. Refinancing turned out to be an earn-win situation to possess banks in addition to their people: Banks penned a number of the brand new payment-generating mortgage loans, and you may property owners had both the lowest-interest financing by way of an earnings-away re-finance, a lesser payment otherwise, sometimes, both.

However with home loan prices these days swinging between 6% to 7% unlike 3% so you can cuatro%, that math don’t works. As an alternative, so much more home owners are using HELOCs so you’re able to power their residence equity.

New renewed demand for HELOCs now could be clear, having individual interest in refinancing a mortgage largely disappearing given that couples home owners having mortgages are able to refinance at the down rates. So you’re able to borrow on present equity as opposed to refinancing, property owners need certainly to trust often domestic guarantee finance otherwise HELOCs.

House security fund would be the swelling-sum service: People use a quantity from the a fixed rate of interest and you may pay-off the loan identical to a fees financing. HELOCs bring a credit line which is there when you require they, and can end up being paid down more than quite a few years.

What Needed for good HELOC (Besides Guarantee)

A HELOC was a personal line of credit safeguarded from the collateral a resident enjoys inside the property. HELOC loan providers allow it to be homeowners so you’re able to faucet doing a certain payment of one’s reduced-out-of portion of its home loan. For example, someone who has a house cherished from the $eight hundred,000 that have $100,000 leftover on their mortgage could possibly tap up so you can 80% of that equity-$240,000-in the form of an excellent HELOC.

دیدگاهتان را بنویسید

برای نوشتن دیدگاه باید وارد بشوید.