How will you Eliminate PMI?

Personal Financial Insurance coverage (PMI) might be fell off financing immediately following specific requirements was came across. Although the decision can be the lending company, its typical for loan providers to need the mortgage-to-value ratio (LTV) are 80% until the PMI should be fell. For each and every lender enjoys different criteria, so be sure to know very well what you’ll get yourself toward in advance of closure the offer.

How to Avoid Investing PMI Versus 20% Security?

The initial and more than obvious means of avoiding investing PMI was to expend a full 20% down-payment. But of course, we commonly blissfully sitting on a pile of money interested in a property.

Pick a normal mortgage with a decreased downpayment needs and no financial insurance policies. Yes, particularly applications exist! When you have a credit score off 620 or even more, confer with your lender because you’ll likely qualify for quite a few of the fresh applications.

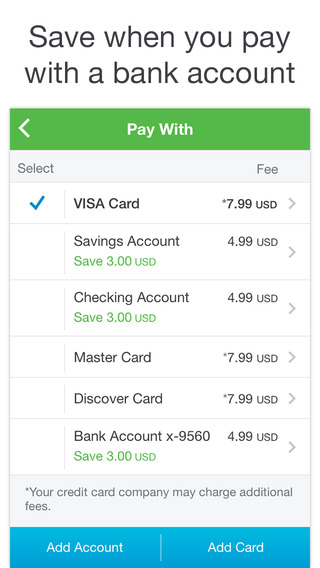

Select a loan provider-repaid MIP otherwise financial-paid off mortgage insurance (LPMI). While this option will not reduce spending the insurance advanced, they changes the dwelling based on how you pay. This one lets the flexibility to possibly pay a lump sum payment and that is dependent on the lender, or even the financial can make a change on the home loan rate that will eventually lead to a larger mortgage payment each month. This may treat being required to generate a holiday or independent payment on the premium.

Another way to stop PMI will be to prefer a beneficial Virtual assistant mortgage. If you are already otherwise features offered in earlier times regarding the armed forces you might seek out an effective Va Financing. Va loans need no advance payment, zero financial insurance coverage, reduced costs, so there are looser borrowing standards than just a traditional mortgage. An excellent Virtual assistant mortgage must be the basic option for any armed forces experienced.

Exactly how much Try PMI Per month?

Exactly how much you only pay to suit your lender’s insurance will vary, but it’s always around step 1% of one’s total loan well worth. The purchase price to you is dependent upon the degree of your own deposit, as well as the position of one’s borrowing. There are numerous means a lender can require PMI money so you can be manufactured, the most popular are a monthly superior. FHA loan providers constantly need a-one-day commission into overall insurance rates prices when the financing is signed.

What is the Difference between PMI and you will MIP?

Although you’re a first-go out homebuyer, you will be aware of financial insurance. But, you will possibly not know there are two many types. Mortgage Insurance premiums (MIP) and personal Home loan Insurance coverage (PMI) each other reduce the lender’s default exposure when consumers pick belongings which have less than an excellent 20% downpayment.

Even in the event each other products admission insurance fees onto customers, PMI and MIP are different. PMI relates to old-fashioned loans with an increase of traditional down payments. MIP enforce just to government-backed FHA money. In the two cases, the insurance coverage prices are passed away to help you consumers.

While individual home loan insurance rates (PMI) fundamentally exists to guard loan providers for all particular mortgage brokers, MIP specifically protects FHA authorities-backed fund.

A MIP (Home loan Top) handles press the site the lending company no matter what quantity of the down payment. Should your debtor pays 10% or even more due to their advance payment, MIP is going to be canceled shortly after eleven decades. MIP include an initial premium with an increase of just one.75% of the mortgage and a yearly premium having a performance from 0.85%. Annual superior include all the way down to own financing regards to fifteen age otherwise faster minimizing loan-to-worthy of percentages.

Personal Mortgage Insurance coverage will bring coverage having traditional financing which will be a rule put because of the Freddie Mac and Federal national mortgage association and a lot away from investors where in actuality the down-payment is actually less than 20%. PMI is instantly got rid of as the financing harmony keeps fallen to help you 78%.

دیدگاهتان را بنویسید

برای نوشتن دیدگاه باید وارد بشوید.