How come Advantage-Founded Lending in the Their state Works?

Whether you are thinking of buying otherwise refinance getting a secured item-mainly based financing for the The state might be a great way to safe the financing enabling one to to complete your targets. By the working with a secured item-created lender into the Their state, you could be eligible for investment by using your current assets since the money, enabling you to get financing regardless of the income peak found on your taxation statements otherwise W2s.

When you’re contemplating increasing your organization but never have the money on give to take action, a secured item-mainly based loan could be exactly what you want. Griffin Capital helps you score a valuable asset-mainly based mortgage when you look at the The state that provides flexible words and you can competitive pricing.

What is a valuable asset-Established Mortgage?

A valuable asset-dependent financing is a type of financing that makes use of verified possessions so you can be eligible for the borrowed funds. This may involve examining, offers, currency market, brings, bonds, common funds, ETFs, and crytpo. Asset-based fund from inside the The state may be used from the people that try not to be eligible for a classic mortgage or should not proceed through the standard app techniques.

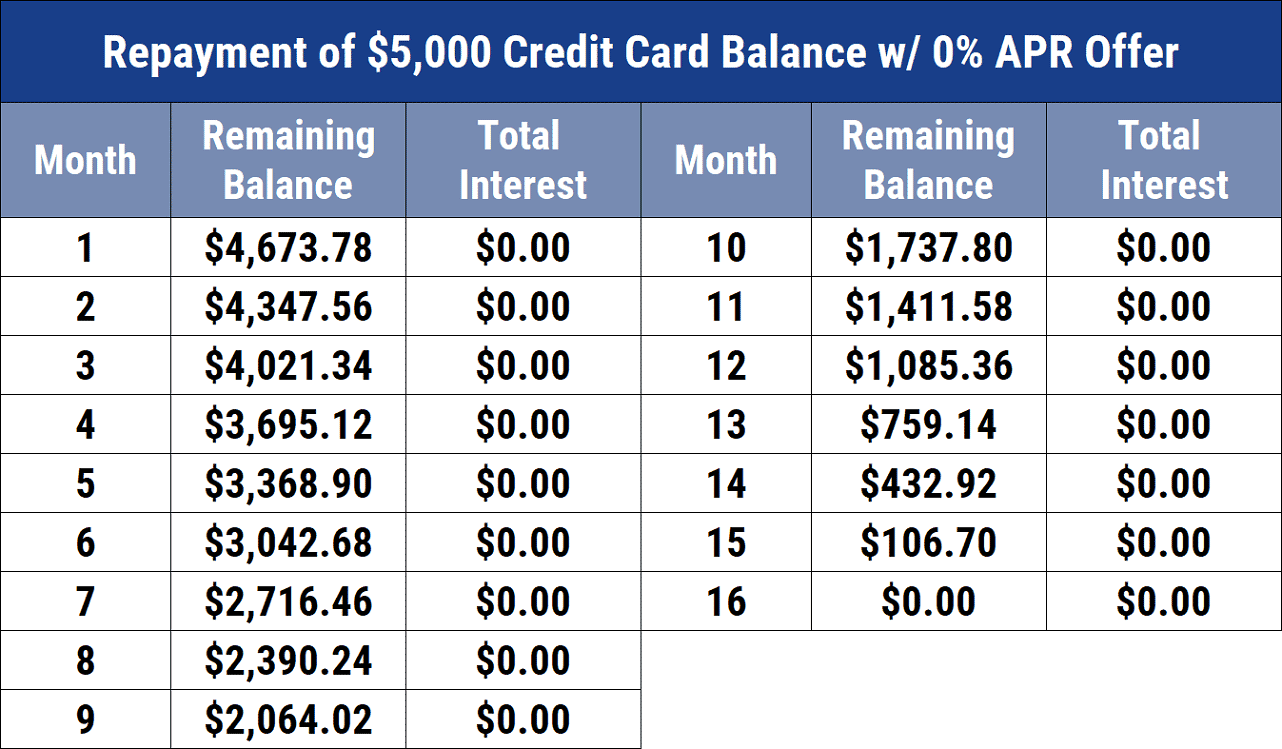

Asset-founded financing also provide accessibility dollars that can be used many different motives, plus broadening a business, resource family restoration plans (ohana, an such like.), settling higher-notice obligations, merging a first and you will 2nd mortgage, to purchase an investment property, and more.

Asset-depending funds are given by the specialization lenders when you look at the The state, instance Griffin Financial support, and can feel designed to get to know this means of one’s borrower.

Asset-built credit inside Hawaii works by utilizing the value of your property to help you safe that loan. The mortgage matter is dependent on the value of their possessions. Such capital is sometimes utilized by people who you want quick access in order to resource and also have the power to have fun with the possessions because the research that they’ll pay back the mortgage.

Asset-oriented financing would be an effective solution if you would like make use of brand new equity of your possessions. When taking aside a secured item-dependent mortgage for the Their state, the loan matter you be eligible for relies on the benefits of one’s property.

If you cannot repay your own investment-mainly based loan, your property can’t be captured because of the financial as you are not necessary so you’re able to promise your possessions. not, in the event you standard on your own advantage-centered mortgage the lending company is foreclose towards the property. Hence, Hawaii asset-built financing make it consumers in order to capitalize on the value of the assets when you’re securing loan providers if your debtor non-payments on the financing.

Benefits of Advantage-Mainly based Finance during the Hawaii

Asset-oriented fund will be a powerful way to accessibility the main city you need to grow your providers or financing a house. Here are a few of benefits of resource-based money from inside the Hawaii:

- Qualify for home financing using only assets, credit score, and you will down payment: Because the an entrepreneur otherwise retiree, you have a number of assets yet not much of cash. With an asset-built loan into the The state, you need the possessions since the earnings to obtain the mortgage need.

- Access as much as $step 3 mil for the financial support: Asset-mainly based loans can provide up to $3 million into the financing, that is a terrific way to get the resource your significance of a major opportunity.

- Versatile throughout the brand of assets you put down for the loan: You are able to several possessions due to the fact earnings for the asset-oriented financing.

- Will get acknowledged despite your earnings level: If you have a good credit score and you can a large amount of property, you should buy recognized to have a secured item-situated financing regardless of your earnings peak.

- Secure home financing to possess property this is not much of your home: For those who hope to purchase a vacation domestic or investment property from inside the Hawaii, you need to use a valuable asset-created mortgage to find the house.

How to get a secured asset-Established Loan within the Their state

If you are looking for a loan and also property, asset-oriented financing inside Their state is generally advisable for you. Some tips about what you should do to help you qualify:

- Reach out to a great Griffin Resource mortgage strategist. We are going to make it easier to determine if a valuable asset-centered loan suits you and you can make suggestions through the techniques.

- Fill in an on-line loan application. This can give us some basic information regarding your financial situation.

- Identify the fresh assets you will employ so you’re able to qualify. Asset-depending funds are derived from the amount of their property.

- Bring requisite files. Once you have decided on this new property you will use, we’re going to need some files to ensure the well worth.

installment loans in Mississippi

دیدگاهتان را بنویسید

برای نوشتن دیدگاه باید وارد بشوید.