Family Equity Mortgage or Domestic Guarantee Credit line: That’s Right for you?

If you’ve possessed your property for more than 5 years, then you have probably benefitted out-of an astounding upsurge in its worthy of. Regarding simply 2017 in order to 2022, You.S. home values rose by the an astounding 40%.

This is why, American residents as if you are in reality standing on more than $twenty eight trillion dollars regarding security. And lots of was actively seeking make use of you to newfound riches. Indeed, the audience is currently in the center of a property guarantee financing growth.

Plus it renders total feel. Domestic collateral money offer a long list of pros. You are able to this new proceeds for almost anything. This may include paying off figuratively speaking, level medical, dental or training expenses, or reducing large-focus charge card balance. It’s a terrific way to reduce your loans.

You might also utilize the fund to create another inclusion or over a property update enterprise. In the event the allocated to upgrades such as, your property guarantee financing might actually help you boost the well worth of your property.

Very, when you have a listing of highest-level systems otherwise financial obligations you’ve been want to deal with, you will be considering a property collateral mortgage because of VACU. We provide a few high options to tap into their home’s security. Issue was: And this alternative will be good for you? Why don’t we talk about to find out more.

Just how can household security options functions?

Called an effective 2nd home loan, a home collateral mortgage allows you to borrow cash by using the security of your home since the security. Security ‘s the number your property is currently really worth, without any quantity of any established financial at your residence.

Unlike a refinance mortgage, house equity finance let you leverage a portion of the value of your house, in lieu of taking right out a special loan to replace the entire first mortgage.

Because the domestic collateral money was covered because of the assets you own, he could be viewed as lower chance. This usually means interest levels which can be lower than unsecured bills like playing cards otherwise unsecured loans.

And since the installment plan can be more than an extended period of time, domestic security money build borrowing from the bank larger wide variety simpler to pay back.

That are more effective to you personally a house equity loan or personal line of credit?

During the VACU, we provide each other an excellent lump sum payment house equity financing and you may pop over to this web-site an excellent rotating home security credit line (known as a good HELOC). Both provide type of differences and you may advantages.

The selection of financing sorts of might depend on a number away from parameters, including your a lot of time-term needs, the small-name requires, and your individual situations. Let’s remark per solution so you can view.

What exactly is property guarantee mortgage and just how could they benefit you?

A home equity mortgage offers the whole quantity of the mortgage in one dollars commission. That it count need to up coming become paid down on a regular basis more than a pre-put timeframe. The attention for the complete amount borrowed will be charged after you obtain the fresh new continues.

Household guarantee funds is getting huge projects otherwise costs such as for instance a primary domestic restorations. A number of the major pros were:

- A fixed payment per month

- A fixed monthly interest rate

- The capability to get better pricing if you undertake automatic import out of your family savings

What is actually a home collateral credit line as well as how you are going to they benefit you?

VACU’s family guarantee personal line of credit (HELOC) allows you to acquire, invest, and you can repay because you go, using your household given that collateral. Normally, you could obtain up to a designated part of your total collateral.

Unlike our lump-sum domestic security loans, a great HELOC offers access to a beneficial revolving credit line as the mortgage is eligible. You’ll then have the independency to make use of as much out-of your own acknowledged borrowing limit as you like, and only pay focus into the number that you play with.

VACU’s family security credit lines bring self-reliance which have repeating expenditures, together with home home improvements otherwise degree-associated will cost you. Several of their big possess and you can experts is:

- A varying payment per month

- A variable monthly interest rate

What exactly are various other advantages of VACU’s household guarantee solutions?

- No settlement costs.

- Funds can be used for whichever mission you like, including home improvement, studies expenses, debt consolidation reduction, unexpected costs, plus.

- You might obtain up to ninety% of your own appraised value of your house, without having the number of your current home loan or any other liens.

- At least borrowing number of $20,000.

How will you decide which option is best for you?

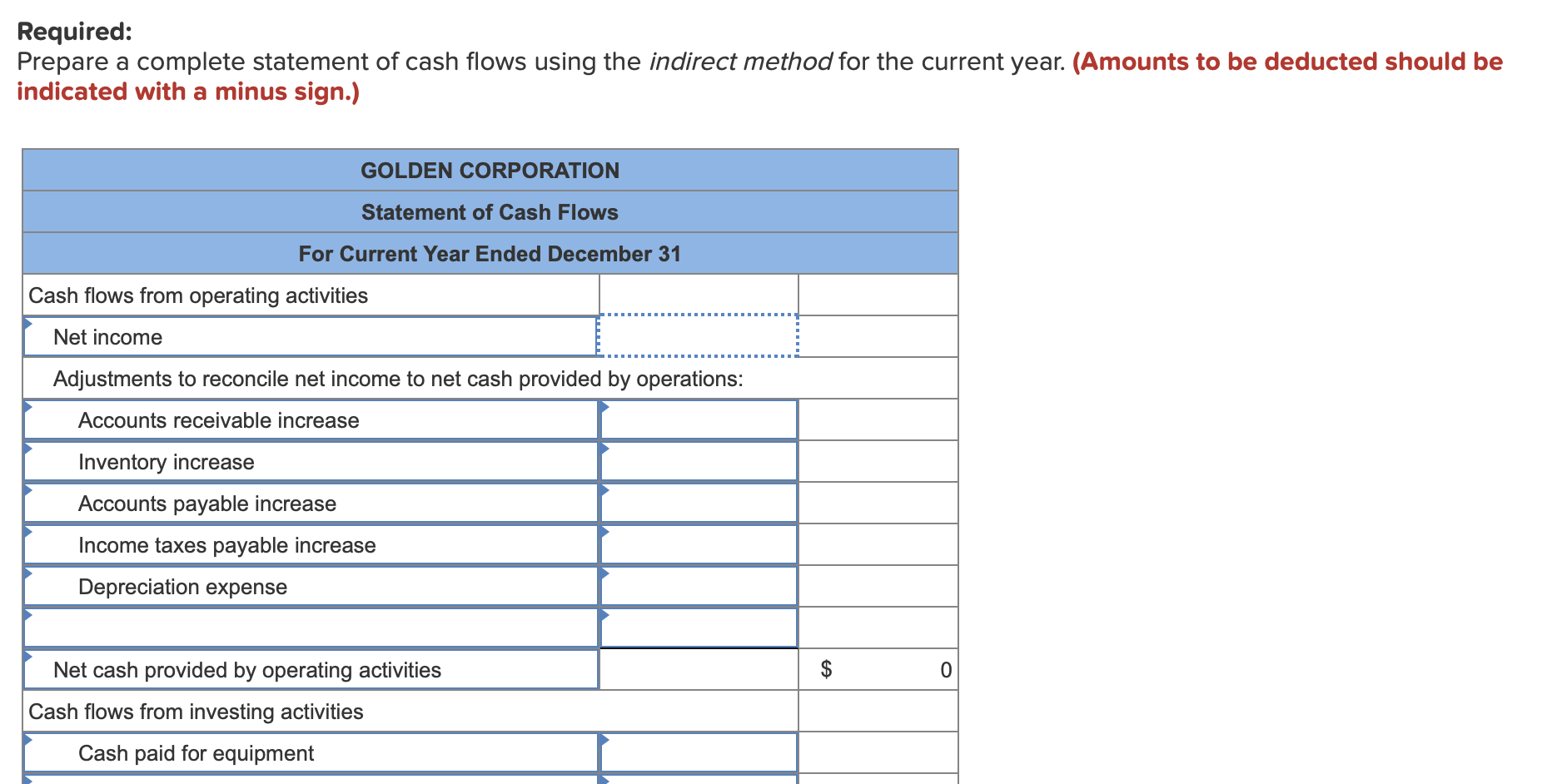

Investigate chart less than to look at and this family collateral alternative can help you reach finally your needs. Inquire a few pre-determined questions to decide and this alternative might be right for you. ‘s the expense you’re looking to fund a one-date expense including merging loans otherwise repeated such college tuition otherwise home improvement ideas? Can you like a monthly payment that is fixed otherwise that’s based about how much you have lent?

Make an application for an excellent VACU Home Guarantee Loan or HELOC

If you are searching into dollars to cover a variety of significant expenditures on your own future, up coming a property guarantee financing or HELOC regarding VACU could well be an ideal solution. The useful associates is respond to a lot more of your personal concerns that assist your know if you qualify.

دیدگاهتان را بنویسید

برای نوشتن دیدگاه باید وارد بشوید.