British house allow pictures standards & on the web services

Articles

You might not need use for those who or him or her have the british armed forces, otherwise work with specific British regulators divisions or perhaps the Uk Council. For those who’ve missing your own brand new stamp or vignette therefore do not provides a great BRP, you ought to get a short-term charge to have travel to the new United kingdom. Whether it’s inside a vintage passport, hold one another your own dated passport and your the fresh passport after you travel. You have still got their indefinite hop out to remain if perhaps you were aside for less than 2 yrs.

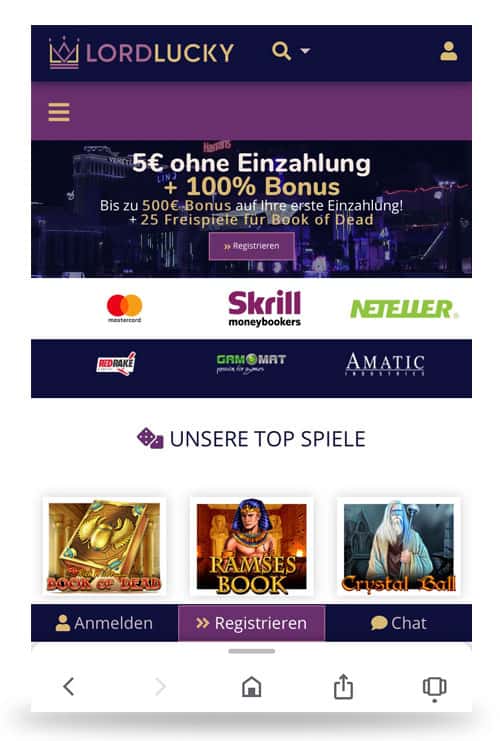

Fee & Webpage

The basic HSBC most recent membership is perfect for individual financial you to is appropriate for every now and then financial means. Might HSBC current membership enables you to withdraw up to 3 hundred GBP per day. Barclays also provides bank account that are suitable for around the world students, along with a corporate profile. This can be an option for which you wear’t you desire proof of target to open up a bank account inside the united kingdom. And is best for those who want to open a good financial in the united kingdom on the internet (also away from abroad). Particularly if you should rescue a lot of cash on currency change, and you can global Atm fees.

Do i need to open a bank account in britain instead an enthusiastic address?

People in america remaining in great britain should understand you to definitely domestic https://happy-gambler.com/derby-dollars/ reputation could be the trick you to reveals or closes such gates. Although not, remember that for each services have its own unique lock, which means there are other criteria otherwise laws to determine eligibility according to abode. Without proper guidance, you may find oneself liable to spend taxation in countries. Although not, this is when the new Twice Tax Treaties (DTTs) come into play. These global preparations ranging from regions make sure the same income are perhaps not taxed twice. DTTs tend to incorporate “tie-breaker” regulations to determine and this nation has the number one directly to income tax.

While the there’s a high probability you’ll rating higher money efficiency which have BTL than simply just about all almost every other well-known possibilities it can become at a cost. In reality, that have on line property sites such as Rightmove and you can Zoopla, and the entire world moving on the internet function it’s never been easier. As opposed to in lots of countries, there are already zero judge limits placed on non people whenever they get Uk possessions. The largest alternatives would be the Neobanks, which the consensus indicates offers something lower with (according to TrustPilot) much better services.

Best of all, you’ll score a reasonable middle-business exchange rate to the conversion process of the money. A visa will give you consent to enter great britain for a great particular time frame, and you will lower than certain requirements. There is minimal log off to stay, and you can long hop out to keep – and this i’ll take a look at 2nd. Delight comprehend the Terms of service for your part or visit Wise costs & cost for up-to-go out details about rates and you can charges.

Nation particular expat taxation suggestions

With your Grey Lbs membership, you can discover money from people country in the uk or other places on the EEA region. It means you cannot discovered money from places away from EEA part. I save a little money by giving the finest guidance on the around the world money import. Lloyds supply company accounts with regards to the proportions and you can return of one’s business.

As a rule, you will basically not felt a tax resident of your British for those who have not already been found in the uk to have 183 or higher in every income tax 12 months. The above financial institutions are some of the best British banking institutions to have non-people, but they’re also not the sole options. Use the list because the a starting point for your look and you may get on the right path to starting a non-citizen family savings in the uk. Providing a debit card is frequently standard now let’s talk about a bank membership, but British banking institutions is generally just about open to you various other indicates. Halifax try a very popular financial institution in the united kingdom, sufficient reason for justification. They prides in itself to the the customer support, plus it’s you are able to to try to get a free of charge newest account on the internet within ten full minutes.

- With regards to relying days, it indicates you are myself within the uk at midnight to your 183 weeks or maybe more.

- For those who pertain inside the Uk and you also meet up with the economic conditions and you may English code standards, you’ll usually score a decision within 2 months.

- You’d as well as face higher detachment costs and always have to check out a lender branch to handle transactions.

- You’ll need to pay so it at the top of people visa costs you may have currently paid back when you joined the united kingdom.

- Maybe not performing this get mean that you are defer otherwise rejected boarding from the companies.

Ideas on how to Plan the fresh Legal Home Sample

When you yourself have dependents, the relevant GOV.British application profiles will show you how they can pertain. It teaches you the new procedures to help you making an application for being supplied permission to reside the uk. Your own dependants (spouse and children) have to pertain separately for an excellent Returning Resident visa once they’re-eligible.

Greatest Financial institutions to have Low-Citizens in the united kingdom

If you’re seeking open a timeless or company checking account otherwise mention alternatives including electronic banking, options are offered. Think of, the secret to a successful banking expertise in great britain is actually information your position, looking around, and you may to make told decisions. Using this book, you’re also well on your way to help you economic balances on your own the new home. To conclude, beginning an excellent Uk family savings because the a non-resident is possible and will offer a selection of advantages.

This can be anything along side same outlines since the a good ROPS (Recognized Overseas Pension Scheme) but domiciled in the united kingdom. We have no doubt, one to in some situations, these could become right for some individuals. But of my viewpoint they break the first rule from money internet explorer only purchase things you know.

Thus, it’s convenient acquiring suggestions about ideas on how to rearrange yours assets to be sure the most beneficial tax therapy. Although not, it has to not completed because of the taxpayers who document an excellent United kingdom Tax Come back. Forgotten earnings comprise principally out of dividends and you can interest; it doesn’t tend to be leasing earnings. The newest tax-100 percent free individual allowance is available to low-citizen British Citizens.