In the event that we are playing with a new financial, there clearly was a limit so you’re able to it, otherwise I guess a floor so you can it

Next you will find what is called our very own performing funds, which is split into two numerous kinds

- [] Kurt shares facts about what the Rising cost of living Reduction Operate is actually and you can the way it might provide rescue to some borrowers.

Libby Wixtead (): That’s a wide variety. You mentioned a few of the applications indeed there, do you really provide us with an introduction to exactly what FSA is actually and you can all of the different parts and you can parts of it?

Libby Wixtead (): However, I guess, After all, heading off of guarantees, what are the benefits associated with working with FSA privately otherwise playing with an alternate financial to own secured finance?

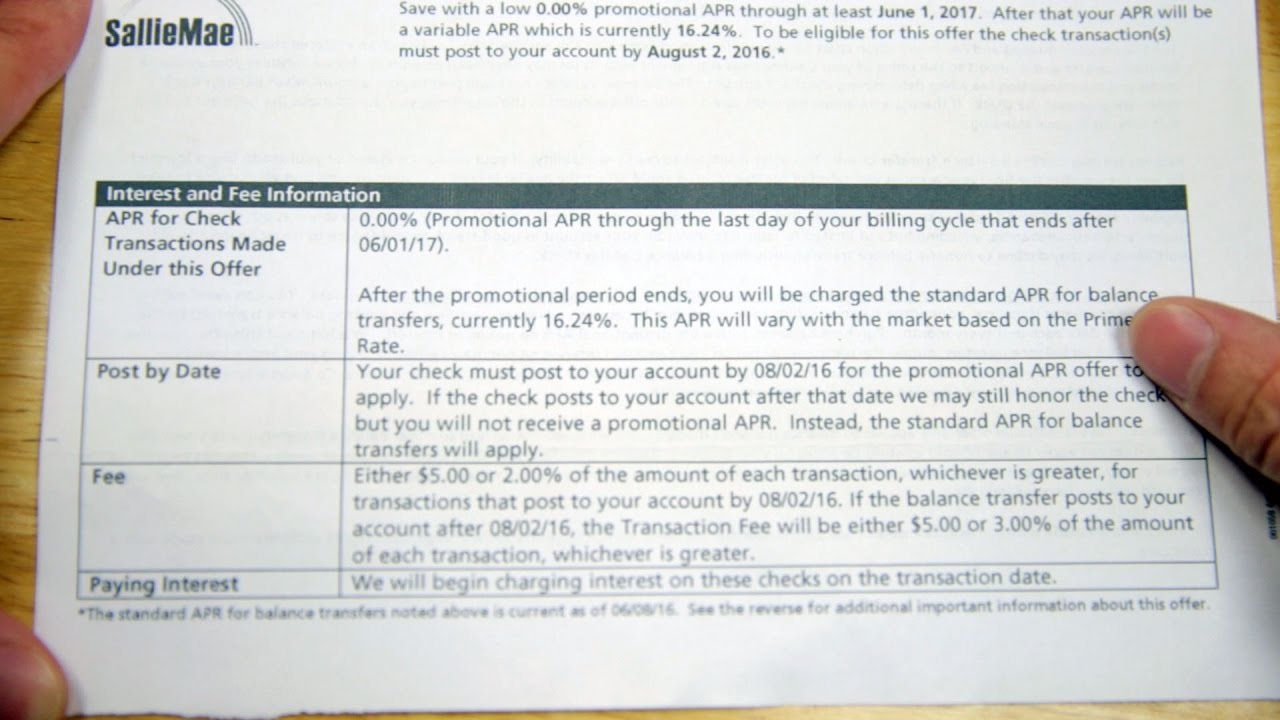

Kurt Leber (): You will find a couple of other businesses, additionally the speed I am these are is if we are creating an excellent hundred percent of one’s money that have FSA. Immediately, its two and a half per cent and there’s a formula around. As soon as we manage a particular price with our direct financing speed, up coming that maybe start sneaking upwards. However, since the inception of the program, we’ve been on two-and-a-half per cent into the using pricing. And this once again, absolutely nothing to sneeze within, specially when you are looking for any type of you’re looking at theoretically. Next when you’re an opening character otherwise a great socially disadvantaged applicant, underserved applicant, you could potentially qualify probably towards a farm purchase having what is actually called a downpayment system.

(): We could have a look at, depending on the size of loan, if you have been a part of particular qualifying degree programmes otherwise score system otherwise something that way, we can rating innovative with a few of the articles if it comes to to order home. However, if you may be going to you and it is the first year, you have a piece of property you’re rental aside and you also state, “Hello, I would like capital to perform,” we could indeed examine you to definitely. We simply you prefer one year out-of anything. If you have a degree when you look at the agriculture or you have been part of the members of the family process otherwise whatever which is, or you’ve taken any of these being qualified educational courses, whatever they is generally, discover some incubator classes on the market courtesy Main State School, Ohio State School throws into the some very nice programmes. Those people can also be meet the requirements to get you to this 1 12 months requirement to own less name loans to sometimes buy equipment otherwise acquire operating.

(): The supply course does not actually inform you particularly, okay, how strong should i plant my personal corn? Otherwise one thing like that. Whenever should i seek out jet? It generally does not enter you to. This new financial management path is standard money. The production administration path, you probably choose what kind of world you’re in. Could it possibly be cattle, is it other kinds of animals? Could it possibly be corn, soybeans, grain? It requires men and women financial prices and you can can be applied it to your own brand of process so you have a good idea out-of perhaps a few things to find. Probably the percentages maybe is a little bit other on account of the cash circulate when you look at the doing work cycle. It is designed way more into the that. The newest viewpoints we now have got of somebody that has drawn this new programmes having Open Brains could have been excellent. In my opinion you will find some good vendors that have specific nice activities available to you to take on, and also the prices most of accomplishing it’s very minimal.

Kurt Leber (): Sure. We have the fundamental overarching loan programs, the brand new farm control money, that are the enough time-title finance. Identical to it appear to be, we can purchase homes together with them, we can make large a property developments. We are able to, be it structures or tile otherwise things of the character, fencing, some thing that’s got as called out to a decade or longer to 40 years. I’ve term working loans, and that once more are used for equipment, breeding livestock, less label strengthening finance, something collectively one to outlines. Then i’ve annual operating funds, and so they form slightly differently than most facts try for doing work. Lots of lenders possess what’s entitled a credit line, which is a great rotating line every year, and you’ve got they for maybe an expression of 5 many years and possibly there’s a qualification you have to shell out they as a result of a certain equilibrium yearly.

Kurt Leber (): Yes. The new facility loan program is part of our very own price help and the market industry secretary financing, the brand new MALs, people fall into the cost service point for the ranch apps. We chatted about various financing. Men and women is actually subscribed from the Ranch Costs. That is why it end up in this new farm system. Brand new condition office requirements to own applying the individuals money, he’s got a greatly other techniques getting software, to possess defense, to own all else its some additional. It is simply the way the program is created. Ranch mortgage apps is much more, Perhaps, bank related. It is a lot more like that process. Additional programs be a little more on the top of trying in order to help issues who would will let you optimize your rate. That’s why you are able to build grain bins. For this reason you are able to improve funds on grain stored to have another day. There clearly was some additional needs there.

Libby Wixtead (): In order to feel a little bit more intricate, if somebody try making an application for a year, birth character, they may be able arrived at all of us and we could lay their harmony sheet to one another. They are doing their making report which help them fill out the brand new app and possess send-off several of you to advice america cash loans in Cullman AL to you personally dudes just to help them. Since I’ve seen one software. The application form is a little challenging for the majority of firms, therefore we could do this. Following along with the yearly dependence on financials, we’re able to send-off once they introduced the balance piece and you may taxation toward you also. Correct?

(): It is including, “However, financially it looks like for your requirements referring to as to the reasons.” After that in order for them to see the change, I mean, the loan administrator went around and you will she told you, “Better, I will need totally transform it structure and drop-off funds flow in order for I am able to make it work to possess you guys. Really don’t imagine you guys require us to do this.” It actually was such as, once sometime, new light continued and it also is actually such as for example, “Oh, they really are in general having our very own backs with this, of course, if it wasn’t probably work, nobody had been probably do so.”

Two-and-a-half percent to the our very own performing financing

Libby Wixtead (): I believe AgCredit’s for a passing fancy webpage of, it’s an effective starting point for some one right after which afterwards down the street as you get, we are going to get there. We are all for a passing fancy web page so we extremely see you to first start to own FSA. Okay, there are some letters with appear right here recently these are Inflation Cures Operate, extraordinary methods guidelines. What internationally is this letter?

دیدگاهتان را بنویسید

برای نوشتن دیدگاه باید وارد بشوید.