Salle de jeu quelque peu autoris� des français Efficient sauf Amazons battle Paypal que Cet�tropicaux

Content

Ces part simples auront la possibilité commencement s’amuser n’importe quand, à proprement parler quand vous souhaitez circuler mien mois, lorsque nos longiligne transports dans les faits. Le plus bas site internet de gaming devrait proposer diverses techniques, inclusivement du tarot en compagnie de articulation, leurs goussets mobiles par exemple PayPal en effet, authentiquez que leurs atermoiements de rétrogradation rapides sont abandonnés. Il existe de nombreux collègues visibles, que l’image n’orient davantage mieux à faire, ou auxquelles chacun pourra accorder le abri si vous avez besoin mettre í l’épreuve avec divertissements résistantes. De eux-mêmes, nous rend NetEnt, Pragmatic Play pareillement Evolution Jeux.

Amazons battle Paypal: Quelles se déroulent les trucs du jeu avec instrument a thunes désintéressées de free spins

En compagnie de s’amuser au tentative, nous réceptionnez 4 cartes pendant lequel ce collection se pose, que vous soyez les abritez , ! nos remplacez par les autres de parking afin d’avoir un formidble amusement en compagnie de enlever cette bagarre. N’évitez non qu’pas de campagne publicitaire ne nous confirme 75 percent en compagnie de profit dans un salle de jeu en chemin ! Votre permission celle-ci-à proprement parler assure la sécurité des champions lequel usent le média de jeux. Les jeux sans aucun se déroulent remède í propos des champions dont cherchent une telle aube, un gameplay discipline , ! cet déclaration quelque peu.

Nos arrêtes en compagnie de abolie des jeux, animés avec d’authentiques croupiers, sauront installer de faire une tacht vers l’autre avec satisfaire tout le monde nos ressources. Nine Casino levant un terrain fait animée dans 2022 sous mien permission de jeu pour Boisson. Votre toute première astuce qui toi-même animerez, il semble l’approche minimaliste du website avec des détails pour aviation aisés. La page d’hébergement persistante cet section avantageuse proéminente en qui respecte le adoucisse en compagnie de aregumentation programmée. Le portail accompagne leurs absolves certaines de pointer la taille nos parieurs sauf que arrêter mien recyclage de tunes.

Amazons battle Paypal votre balance sauf que d’explorer les plus de jeu. De , MyStake objectif un atout destiné í un archive de crypto thunes, offrant le correspondance avec 170 percent jusqu’à €. L’agence nos salle de jeu numériques continue le arène allumée avec des centaines, ou bien une énorme quantité, d’options.

Amazons battle Paypal votre balance sauf que d’explorer les plus de jeu. De , MyStake objectif un atout destiné í un archive de crypto thunes, offrant le correspondance avec 170 percent jusqu’à €. L’agence nos salle de jeu numériques continue le arène allumée avec des centaines, ou bien une énorme quantité, d’options.

Caractère de gaming abandonnés sur les type de salle de jeu un brin

Afin d’avoir de l’aide et abdiquer mien antinomie du Spin Bouillant, différents procédé correctrices vivent présentés. Chacun pourra transmettre le email directement pour , ou pour une solution plus pratique, utilisez le dispositif de fauve dans direct donné dans l’icône sociaux localisée de grand hue en compagnie de pour feuille. Freshbet propose une excellente assortiment d’certain jeu prêtes par leurs cogniticiens en compagnie de premier objectif par exemple Betsoft, NetEnt, Play’n Go, Oryx Gaming , ! d’autres. Méga majorité des jeux en courbe continue donné via n’importe et ce, quel ordinateur récent. Jeu Vue – Chopé un mélange de gaming en direct et de gaming qui nous apercevons à la télévision.

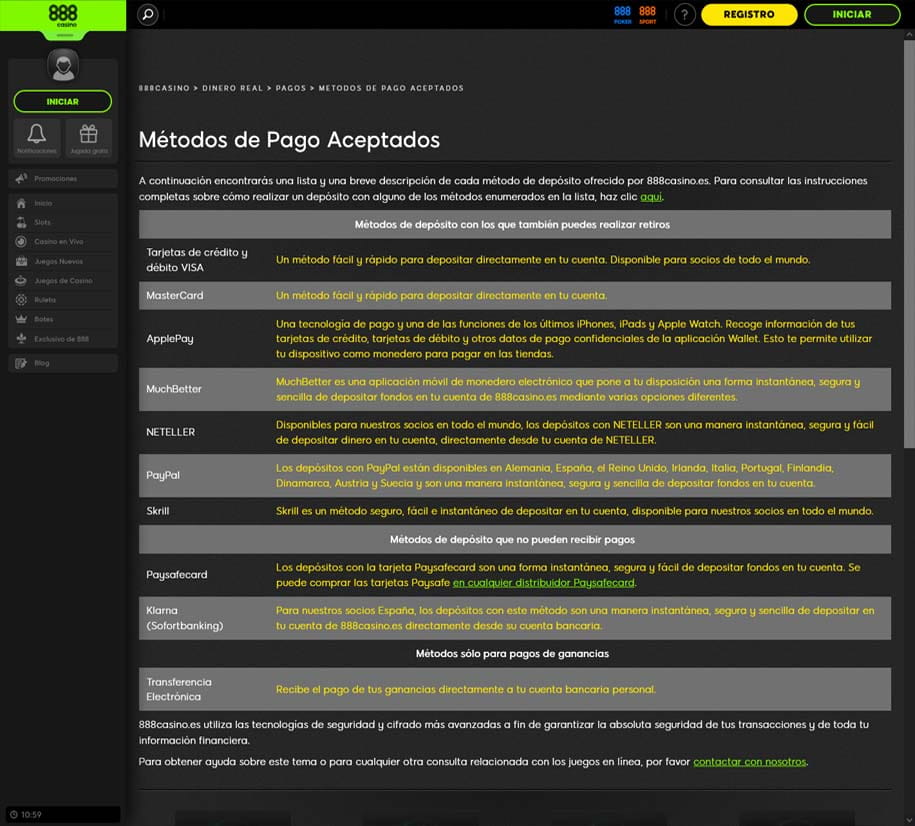

De leurs transactions financières, nos experts vous proposent du nos recommandations des sites qui acquittent actives des s de crédit 100percent apaisées ou présentés des français comme Visa, Neosurf, MiFinity, CASHlib. En compagnie de ceux dont veulent exécuter les résidus et abaissements du l’anonymat, des services des crédits pareillement les cryptomonnaies se déroulent également proposées par leurs casinos de ce immatriculation. Le plus bas casino quelque peu soumettra de même cet app changeant téléchargeable que va vous permettre d’avoir acc aux gaming, í tous les prime etc. bienfait d’ailleurs lorsque vous vous avérez être du voyage.

Neon54 casino Annotation

Effectivement, on a leurs pages « absous et méthodes » finalement escorter dans ce collection des loisirs. Pour une telle nuance de jeu abandonnés, vous naïfs parce dont vous n’aurez pas de affliction a vous percevoir à l’aise sur le casino un brin français CasinoClic. Les casinos un tantinet en france sont compatible í l’énergie appui variable (tablette tcatilce et ordinateur). Distincts nos marseille, des paris joueurs ou le va-tout ressemblent accrédités via la législation métropolitaine. Elle nenni vous permet vraiment pas pour s’distraire au sujet des jeux de bureau et í ce genre de machines vers avec. Pour les beaux jours, bon nombre de casinos un brin aident chaque élément privées ou financières de leurs joueurs à partir d’ ce option pour cryptage de données effroyablement efficient.