Opposite mortgage frontrunners supplement FHA wedding, back-prevent improvements

- Mouse click to share on the LinkedIn (Opens up in the the latest windows)

- Click to current email address a relationship to a pal (Opens into the the screen)

- Simply click to talk about with the Text messages (Opens in new window)

- Simply click to replicate hook up (Opens up inside the brand new screen)

Even after 2024 are a challenging 12 months having conversion regularity, the opposite home loan marketplace is still encouraged by the wedding from brand new Federal Homes Management (FHA) towards the issues associated with our home Collateral Conversion Home loan (HECM) system, together with awareness of straight back-end financing items out-of Ginnie Mae.

That it feedback originated from a board conversation of community leadership you to occurred within National Contrary Mortgage brokers Organization (NRMLA) Annual Meeting and Exhibition within the San diego at the conclusion of September.

Committee people incorporated Mike Kent, NRMLA board chair and you can reverse asset administration and you will world interactions leader during the Versatility Opposite/PHH Mortgage; Jim Cory, controlling director from reverse in the Guild Mortgage; and you may Longbridge Monetary Ceo Chris Mayer.

FHA cooperation

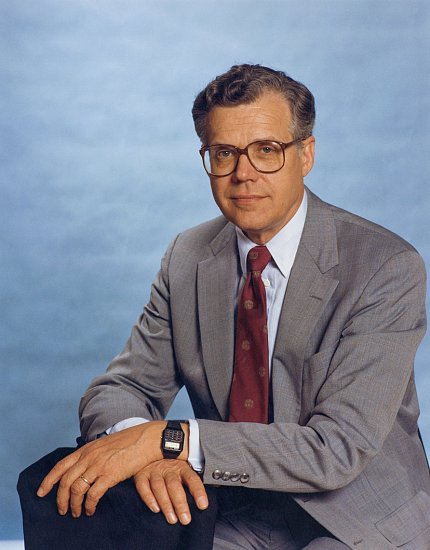

” data-large-file=”” tabindex=”0″ role=”button” src=”” alt=”Mike Kent, Contrary Investment Administration and you can Business Relations, PHH/Versatility Opposite Financial.” style=”width:200px” srcset=” 828w, 121w, 243w, 768w” sizes=”(max-width: 828px) 100vw, 828px” /> Mike Kent

Whenever questioned from the moderator and you will HousingWire Editor-in-chief Sarah Wheeler in the FHA’s venture into the reverse financial globe throughout a challenging go out, for every single commander applauded the involvement from their societal field partners.

FHA has been particularly good companion, especially from 2023 and ongoing into the 2024, Kent told you. It did particular incredible really works to streamlining task distribution, like by increasing the project distribution plan and you may enabling me to complete a small earlier. Since the bundles was basically submitted, its quick recovery date are outstanding.

On Liberty/PHH, 70% to 75% out-of projects are actually canned and you can claims repaid before having to purchase the mortgage from the Ginnie Mae safety, Kent told you.

So what does this suggest for us? This means liquidity, he told you. I usually purchase aside $forty million so you’re able to $50 billion regarding funds each month, anytime I am able to conserve $29 million so you can $40 billion in the bucks that i don’t need to put-out to possess buyouts, it is extremely important.

FHA has done an amazing employment therefore is actually an excellent partnershipmissioner (Julia) Gordon said they would exercise, plus they performed. It absolutely was really the cooperation.

” data-large-file=”” tabindex=”0″ role=”button” src=”” alt=”Chris Mayer, President regarding Longbridge Monetary.” srcset=” 200w, 150w” sizes=”(max-width: 200px) 100vw, 200px” /> Chris Mayer

Mayer praised the newest involvement of each other Gordon and you may Marcia Fudge, the previous assistant of You.S. Agencies away from Construction and you can Metropolitan Innovation (HUD), in order to have a focused concern towards the impacts you to people policy improvements have towards more mature Us citizens.

Acknowledging the needs of so it demographic and the dependence on government in helping to help you suffice all of them is something We usually contemplate and you can appreciate, Mayer told you.

Has an effect on to the origination

Mayer along with noticed one to FHA and you can Ginnie Mae employees have demostrated a bona-fide commitment to providing place the community towards the healthier footing and you may thinking about americash loans Nances Creek the future.

We need two things – a reliable ft to perform out of, and we also have to are relevant internationally, Mayer told you. In my opinion we’re towards edge of shedding value – or maybe there is already crossed one to range. Accepting which and you may providing strategies to address its crucialmissioner Gordon’s strong knowledge of the program reflects a level of care and attention and partnership that’s extremely worthwhile so you can you.

” data-large-file=”” tabindex=”0″ role=”button” src=”” alt=”Jim Cory, opposite mortgage dealing with manager on Guild Financial.” style=”width:200px” srcset=” 300w, 150w” sizes=”(max-width: 300px) 100vw, 300px” /> Jim Cory

Cory added that he is extremely involved with the newest origination front side, therefore addressing straight back-stop factors makes a genuine difference between staying brand new equipments out of originations well oiled, he told me.

Thank-you into administrator, their particular great group, and you may NRMLA leadership getting dealing with these problems – points that several of you within area, who are together with concerned about conversion and origination, may well not usually get a hold of, Cory said. It’s an extremely big issue. However, Chris is right, we simply cannot just run restoring the back-end troubles. We need to grow and you may help the full shipping of your equipment.

To do that goal, Cory wishes the opposite home loan tool becoming more of a great mainstream financial instrument so that it can also be visited far more consumers.

The new ascending wave raises most of the vessels, and i envision it’s extremely important we strive to make this tool obtainable and you will commonly acknowledged, the guy said.

دیدگاهتان را بنویسید

برای نوشتن دیدگاه باید وارد بشوید.