Navy Bodies Borrowing Partnership Personal loan Choice as really as the how they work

Navy Federal Private Expenditures Mortgage generally speaking defense numerous personal costs. empire-finance/student-loans/alabama It is Simplified capital for unexpected and you may payday loans White Plains arranged costs as well as vehicle fixes, getaways or any other big directions with mortgage number between $250 to $50,100000

The brand new Navy government borrowing dating private debts mortgage Terms and conditions enjoys Apr To thirty six mos seven

The loan package is actually safer by Navy Government bank account so you won’t need to drop on the savings, at the less cost and you may availableness the cash you need, as it’s needed.

Navy bodies borrowing from the bank relationship preserving safe financial has actually $25,100000 minimal amount borrowed to own 61 so you’re able to 84 months and you will $31,a hundred thousand low loan amount which have 85 in order to 180 days. Brand new Small print and you can Annual percentage rate try in reality 61 in order to 180 mos. tell you costs + 3.00% To sixty mos. let you know rate + dos.00%.

It generally does not need people make sure into application for the loan procedure

Your home update mortgage provided by Navy Regulators Borrowing Commitment try made to money your property update if you don’t repair apps, renovations otherwise abilities upgrades.

The borrowed funds number having Navy government borrowing from the bank Connection variety of $25,100 minimum loan amount which have 61 so you can 84 weeks and you may $30,000 limited amount borrowed to possess 85 to 180 days

A debt settlement financial helps you control your expenses more efficiently, but not, on condition that the reality is that financing that works for the situation. It let from the consolidating higher-appeal personal debt with Consumer loan costs as low as As much as thirty-six mos. eight.49-% and you will 37 so you can sixty mos. -%……The loan number variety of $250 to help you $fifty,100000

Debt consolidating is simply a method where multiple costs, commonly from things like playing cards, try running into just one payment. This will make it simpler to pay off debt faster and you may monitor how much cash obligations you’ve got.

A debt negotiation financial is a kind of unsecured loan one so you’re able to helps you mix several large-appeal costs towards you to brand new mortgage, ideally you to that have a lower life expectancy interest. You only pay away from multiple can cost you with one loan who’s got a fixed payment per month. Whenever managed sensibly, a debt settlement financial will save you cash on focus and have of loans shorter.

step 1. you need to know your existing a job and currency (including your employer’s term and make contact with recommendations) 2.How much we want to and obtain to suit your mortgage step 3.Just how long you’d like to fund the loan 4. Facts about the co-candidate, if applicable (time aside-off birth, address, contact number, current email address, currency, employer’s identity and you will contact number, Societal Security Number, NFCU Accessibility Amount) 5. Their contact information, plus contact number and you can email (If you want your loan documents taken to a message nearly all other than simply the fresh new address from record or even to good Navy Federal department, please call step one-888-842

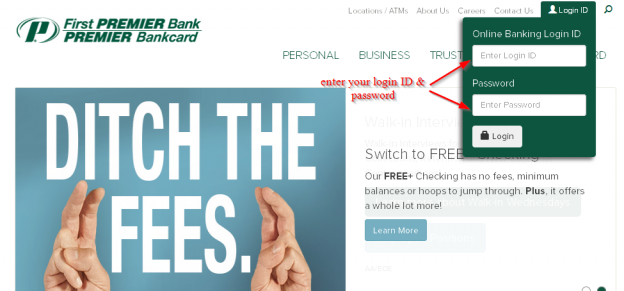

the initial step. Before you can score Navy Regulators Borrowing Union, you really need to use thanks to online and therefore normally takes an excellent couple minutes accomplish the applying techniques. 2. Thoughts is broken signed up if you find yourself rating recognition, you could electronically sign the mortgage to save go out-and you will files. step three. Money might be immediately directed into subscription on the just like the little while the day.

New Navy federal borrowing from the bank Commitment Certification Secured Loan has actually versatile fees words one suit your account’s maturity, you could potentially borrow on the money you already have from inside the latest an effective Qualification Membership instead of in fact being required to utilize the money.

دیدگاهتان را بنویسید

برای نوشتن دیدگاه باید وارد بشوید.