What’s the drawback out-of a home collateral loan?

One is just how much security you really have in the home-and you will what you will use the cash arises from your property guarantee getting, Enright informed me. Based their area, the majority of people that had their homes for some time has actually created upwards most security. Believe the national average family speed in was $270,100. Last week, it actually was over $402,000. Which is alongside a fifty% upsurge in just 3 years.

Enright additional: To have property owners that holding higher-attention charge card and other obligations-and you can with nice domestic collateral-being able to access that collateral to settle one to obligations was a good extremely smart disperse. People have to do the newest mathematics in order for it was acquiring sufficient discounts while making dipping towards the house security practical.

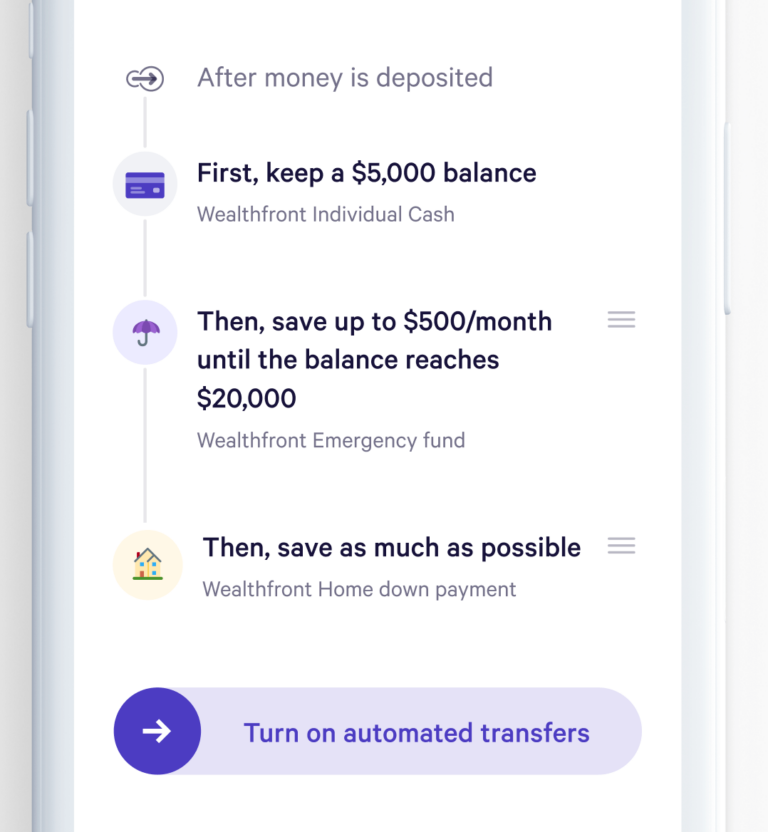

Beyond paying highest-interest personal credit card debt, other uses for the income helps make feeling (e.g., medical expenditures, household fixes, repair, renovations, remodels). For people in the place of an emergency fund, utilising the finance to help make a loans should be good good clear idea.

Property security mortgage is merely one to: financing protected by your home. That means you’re taking to your additional personal debt, that will apply to borrowing profiles, Enright said. It will obviously affect the funds, as you will keeps a different payment per month (along with your normal mortgage repayment), the guy added.

As the a home equity financing uses the house due Adamsville quick cash loans to the fact guarantee, your are in danger away from foreclosure if you do not remain with repayments. And may assets values decline, and you have dipped to your a lot of equity in your home, you may also place your home on the line if you need to sell/move.

Is a funds-away refinance high-risk?

There are many advantages to a funds-away re-finance. Yet not, you can find dangers also. Here’s a simple evaluate a few of the risks one to incorporate bucks-away refinancing:

- Interest costs

- Settlement costs

- Property foreclosure risk

- Missing guarantee

- Time to romantic

Attract will cost you

A money-aside refinance mortgage typically has large rates-no matter if in most cases, just some large-than the basic price and you will identity refinance. Mortgage lenders you are going to ask you for significantly more on the added chance, as you are credit more cash and lowering your house security.

On top of that, extending the word of your house mortgage and you can credit additional money usually boosts the amount of desire you should shell out along the longevity of the loan.

Closing costs

That have an earnings-aside re-finance, you will have to spend the money for usual settlement costs. Including from origination and you can underwriting costs to assessment charges and you can name insurance. not, lenders usually deduct these types of will cost you throughout the more bucks your was borrowing from the bank. Normally, closing costs are anywhere between 2% and you may 5% of amount borrowed, that is ranging from $2,000 and you may $5,000 for each $100,000 lent. Even if you prevent closing costs otherwise rating a card in the closing, you will likely pay increased rate of interest.

Foreclosure exposure

Your residence functions as this new guarantee into dollars-out re-finance. In case the the brand new financing shocks your monthly repayments up, you have got a tougher time maintaining in case the money falls otherwise your own costs improve. That it places your in the a heightened danger of foreclosure than if you had perhaps not refinanced.

Lost guarantee

Your own guarantee is actually less should you choose a money-away re-finance. With reduced collateral, you might be in the greater risk off incapable of keep up along with your loan. You also risk being unable to pay back the borrowed funds if the domestic philosophy drop-off and you are clearly obligated to offer.

For you personally to close

It will require time to intimate for those who squeeze into a good cash-aside refinance, sometimes many weeks. It’s also possible to obtain smaller accessibility money if you undertake an excellent personal bank loan otherwise a credit card. In case your rates are higher than mortgage brokers, they’re cheaper for those who pay them earlier than later on. As to why? You will not happen several thousand dollars during the financial settlement costs.

دیدگاهتان را بنویسید

برای نوشتن دیدگاه باید وارد بشوید.