Virtual assistant Entitlement Calculator: How much cash Entitlement Would I have?

And it may end up being just as difficult if this is their 2nd big date. Reusing Virtual assistant entitlements has numerous questions about loan limitations, how much entitlement you’ve got left, and.

Upcoming, you assess simply how much you have got according to research by the county’s financing restriction and you may circulate with the getting the property you have always wanted.

What exactly are Basic and you can Tier 2 Va Entitlements?

This gives your own bank depend on to allow them to provide the Va Loan which have zero downpayments and no PMI. And it provides a different possible opportunity to have more than step 1 Virtual assistant Financing simultaneously.

If you’ve never used entitlement prior to or perhaps the Agency from Veterans Points (VA) keeps restored their entitlement, starting with what exactly is titled Basic Entitlement. It’s $thirty-six,100000 to possess home loans not as much as $144,000.

Veterans and you will energetic-responsibility servicemembers qualify for Level dos Entitlement (often referred to as incentive entitlement) when you are going for a home more $144,000. The new Virtual assistant claims $36,one hundred thousand of First Entitlement and you can twenty five% of the county’s loan maximum.

With her, each other different entitlement blend as your Full Entitlement, providing you with one particular money you can easily to order property.

Calculating Your own Left Va Entitlement

Calculating their left Va Entitlement can be done yourself otherwise with the help of a skilled lender. Earliest, second Level, and you can left entitlement computations are definitely the common we come across that have the house buyers i work on.

Earliest Entitlement Calculation

You are getting $thirty six,000 in basic entitlement throughout the Virtual assistant if you are amount borrowed try below $144,100000. This new Certification away from Qualifications (COE) tells whether or not your stil hold First Entitlement or perhaps not.

We seen consumers see sexy residential property from inside the Tennessee and you may North carolina where finances and receive investment in case there is default.

۲nd Level Entitlement Formula

With an excellent Va bank, you can simply take twenty five% of county’s Virtual assistant Financing Limitation and discover the amount from entitlement once you have made use of the basic upwards.

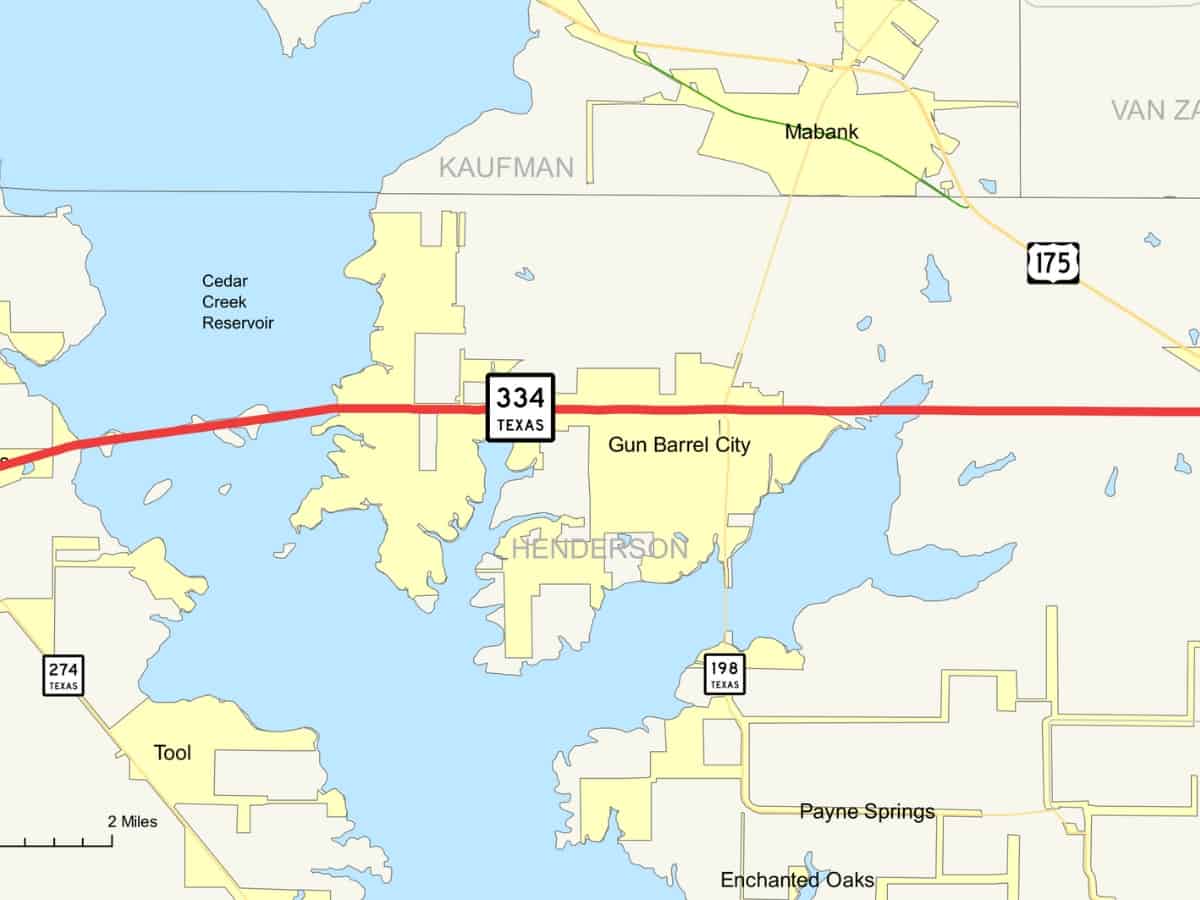

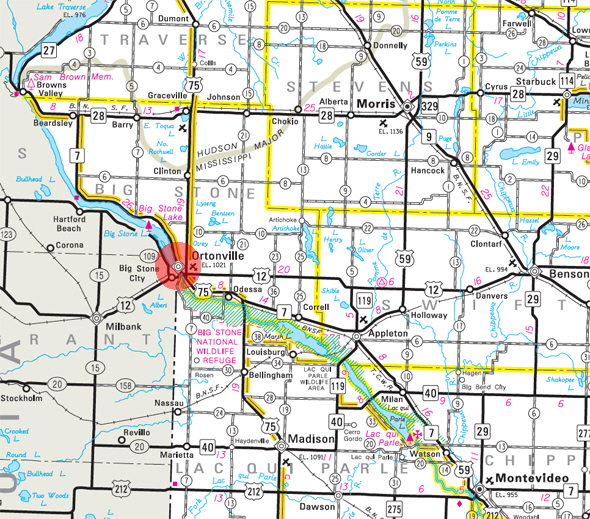

A familiar condition we’ve present in Washington is clients that disperse to Maricopa State. While the financing restriction was $647,2 hundred, would certainly be entitled to a 2nd Level Entitlement out of $161,800.

Remaining Entitlement Computation

You have already utilized the $36,100 Earliest Entitlement and you may exactly what the Va phone calls complete entitlement but need it some other assets.

In these cases, an experienced financial walk you through an easy picture in order to calculate their remaining entitlement. They send returning to the last Va Loan and use it getting training the fresh new amount.

You can even move to the new Vanderberg Sky Force Foot inside the Ca because of good PSC, yet not have entitlement remaining.

That have made use of all your valuable entitlement, the Virtual assistant carry out capture 25% of the brand new county’s Va Loan Limit ($783,150 from inside the Santa Barbara) and you will deduct the fresh new entitlement you’ve made use of from it.

Virtual assistant Mortgage brokers do not require a downpayment for as long as you stand for the Earliest and you can second Tier Entitlement wide variety. For folks who rise above, the financial institution asks for money right down to manage its money.

You could use the Virtual assistant Financing buying property having an optimum amount borrowed that is comparable to otherwise less than the rest entitlement.

We bad ceedit loan in Plattsville feel this is your family members’ consider real time new American Dream and enjoy this excellent Country you’ve sacrificed to possess. Because of the working with an experienced Va Lender, they help you to get the biggest screw for your Virtual assistant entitlement dollar.

Va Mortgage Restrict from the State

Brand new Virtual assistant try a federal government agency you to knows you and your companion is stationed or retiring when you look at the a far more pricey area of the nation, particularly Ca. They adjust Virtual assistant Mortgage Limits depending on the cost of living of your own variety of county.

You can get your dream house with believe understanding the Va can give adequate. Remembering their armed forces provider, the fresh new Dept. away from Pros Things award you with a lot of dollars to help you enjoy that have a zero downpayment home loan.

Take a look at some other conforming mortgage limitations for every condition. Very states feel the fundamental Va Mortgage Restrict away from $647,two hundred and work out it simple to calculate your own next level entitlement.

Entitlement getting Basic-Big date otherwise Knowledgeable People

Virtual assistant Entitlement is for any productive-obligations service user or seasoned that is willing to buy the household the family members’ constantly desired. It’s the greatest time to purchase property close the station or to relax near family unit members on your own last house.

You will find a small grouping of armed forces-focus on loan providers you to definitely see the procedure for to order a 1st or 2nd home with brand new Virtual assistant Loan. Our team is ready to reply to your inquiries and you may walking you from Va Financing Excursion action-by-action.

Call us today on (480)-569-1363, so we can also be prize you for your latest or prior armed forces provider to that Higher Nation.

دیدگاهتان را بنویسید

برای نوشتن دیدگاه باید وارد بشوید.